SQL • Python • Power BI • DAX

Credit Risk Analytics

& Policy Scenario Analysis

End-to-end credit risk analytics focusing on customer behaviour, affordability indicators, and policy trade-offs.

SQL • Python • Power BI • DAX

End-to-end credit risk analytics focusing on customer behaviour, affordability indicators, and policy trade-offs.

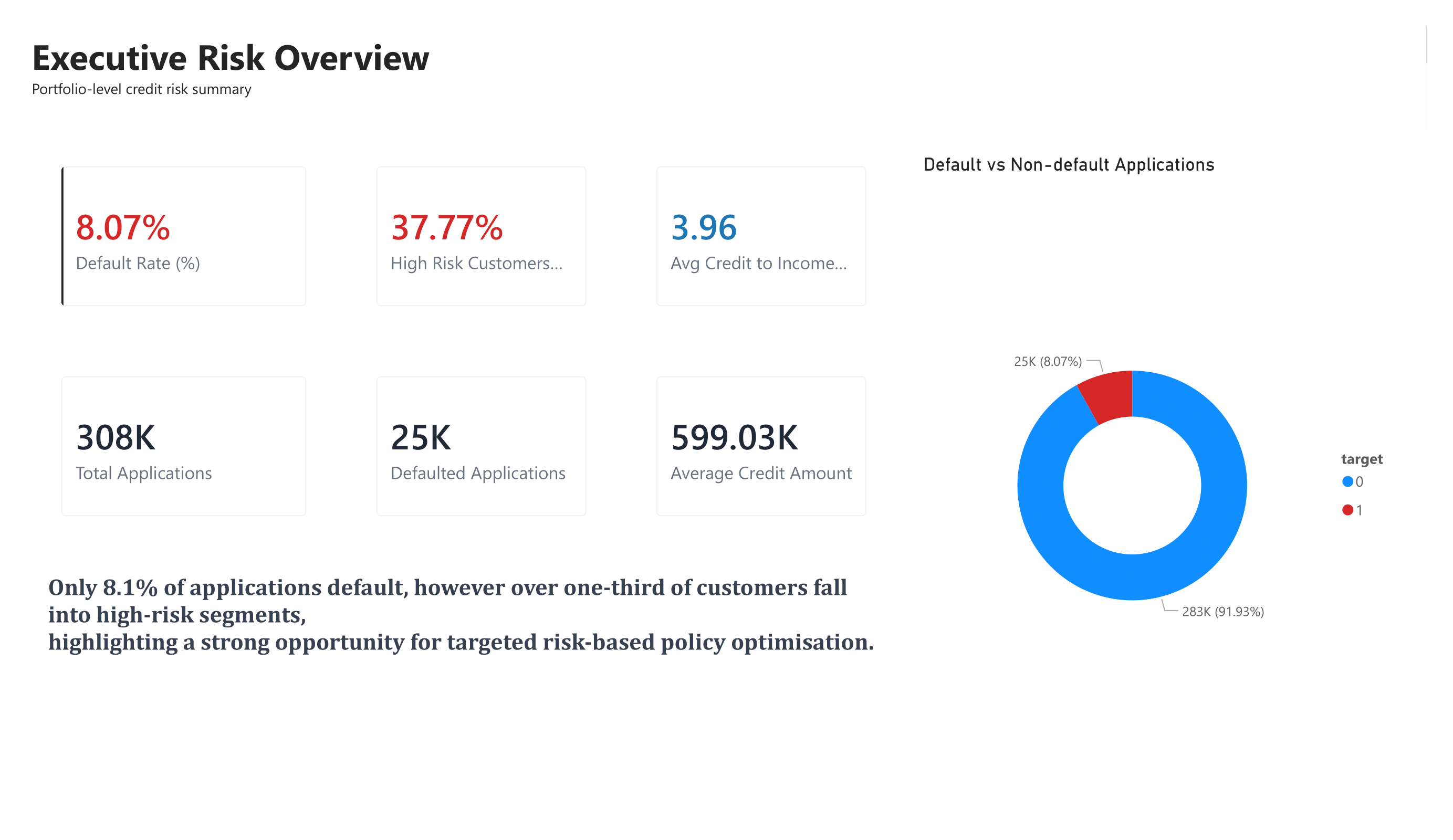

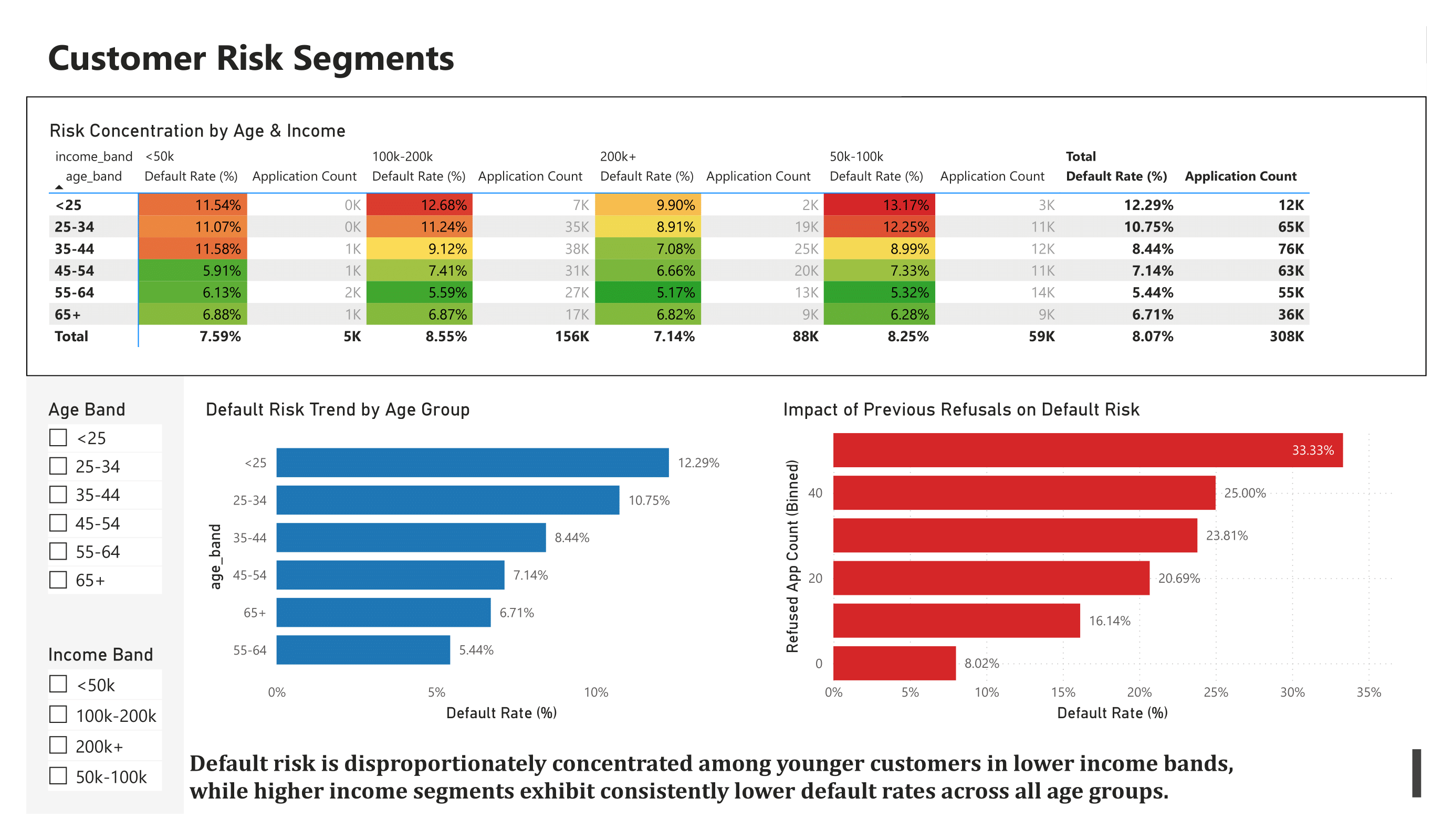

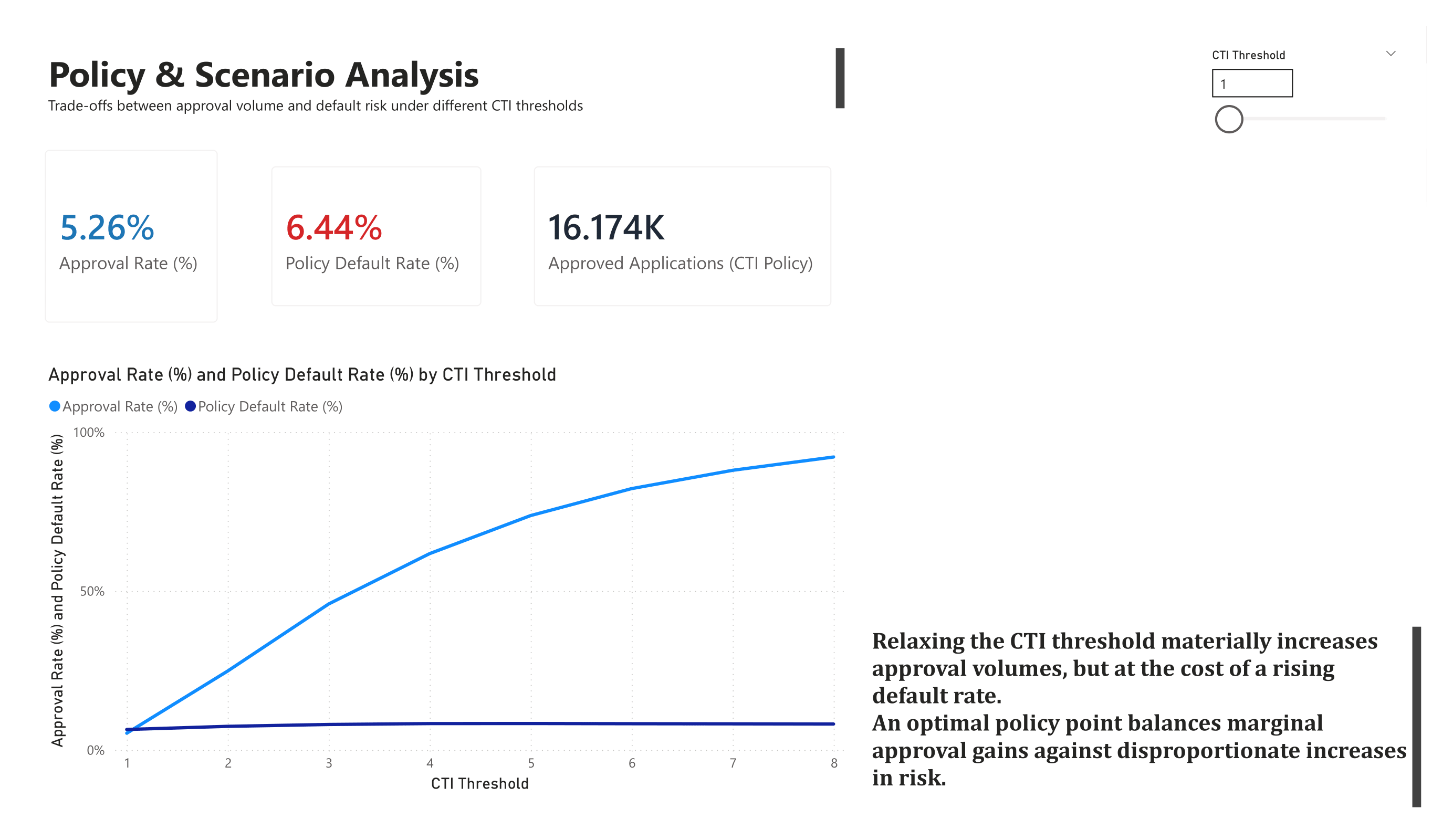

This project analyses consumer credit risk at a portfolio level to identify high-risk customer segments and quantify how credit policy decisions impact approval volumes and default outcomes.

A SQL-first workflow was used for data preparation and feature engineering, followed by exploratory analysis and interactive dashboard development in Power BI.

~8%

Portfolio risk health~35%

Risk concentrationApprovals ↑ / Risk ↑

Policy optimisationRefusals ↑ defaults

Decision feature

SELECT

age_band,

income_band,

COUNT(*) AS applications,

SUM(CASE WHEN default_flag = 1 THEN 1 ELSE 0 END) AS defaults,

ROUND(

SUM(CASE WHEN default_flag = 1 THEN 1 ELSE 0 END)::DECIMAL

/ COUNT(*) * 100, 2

) AS default_rate

FROM credit_applications

GROUP BY age_band, income_band

ORDER BY default_rate DESC;

This query underpins segment-level default analysis used to evaluate credit policy decisions.